Solar Tax Credits In South Carolina

Rebates, Solar Tax Credits And Solar Incentives Available In South Carolina

State Solar Tax Credit

State Solar Tax Credit

South Carolina has a great statewide solar tax credit.

It is 25% of the cost of a system but it is limited to a maximum claim for $3,500 per year.

However, you can claim the remaining portion of the tax credit above $3,500 per year in future tax years and so it is fair to say it is a true 25% solar tax credit.

Residential Solar Energy, Small Hydropower, and Geothermal Tax Credit for South Carolina.

Duke Energy Progress Customer Scale Solar Rebate Program

This program offers Duke Energy Progress Customers $1 per watt to install solar panels for their homes.

Duke Energy Progress Customer Scale Solar Rebate Program

South Carolina Electric & Gas (SCE&G)

Net metering in South Carolina

All of the major utilities in South Carolina offer net metering meaning you can bank on the full retail value for each kWh of power.

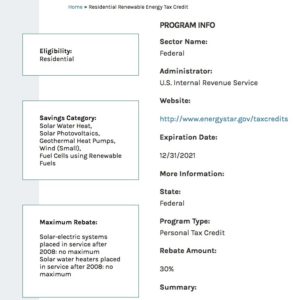

Residential Renewable Energy Tax Credit

Under the Bipartisan Budget Act of 2018 which was signed in February 2018, a number of tax credits for residential energy efficiency that had expired at the end of 2016 were renewed. Tax credits for non-business energy property are now available retroactive to purchases made through December 31, 2017. Tax credits for all residential renewable energy products have been extended through December 31, 2021, and feature a gradual step down in the credit value.

Additional Solar Tax Credit Programs for commercial and private parties in South Carolina.

*Disclaimer: The tax credit information contained within this website is provided for informational purposes only and is not intended to substitute for expert advice from a professional tax/financial planner or the Internal Revenue Service (IRS).